Facebook’s plan to operate its own digital currency poses risks to the international banking system that should trigger a speedy response from global policymakers, according to the organisation that represents the world’s central banks.

Although the move of big tech firms such as Facebook, Amazon and Alibaba into financial services could speed up transactions and cut costs, especially in developing world countries, it could also undermine the stability of a banking system that has only just recovered from the crash of 2008.

Echoing warnings from many tech experts, the Bank for International Settlements (BIS) said that while there were potential benefits to be made, the adoption of digital currencies outside the current financial system could reduce competition and create data privacy issues.

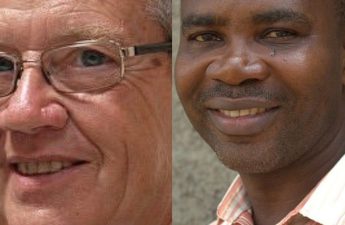

“The aim should be to respond to big techs’ entry into financial services so as to benefit from the gains while limiting the risks,” said Hyun Song Shin, economic adviser and head of research at BIS.“Public policy needs to build on a more comprehensive approach that draws on financial regulation, competition policy and data privacy regulation.”

The warning from the BIS on Sunday comes only days after Facebook announced it would launch its own digital currency, Libra, in 2020. It will allow its billions of users to make financial transactions across the globe in a move that could potentially shake up the world’s banking system.

Chris Hughes, a co-founder of Facebook, last week added his voice to concerns being expressed over big tech’s move into finance, warning that Libra could shift power into the wrong hands.

NAN